Will International Equities Continue to Outperform the US?

There are signs of weakness if you take a deeper look

The iShares MSCI EAFE ETF (Ticker: EFA), which “seeks to track the investment results of an index composed of large- and mid-capitalization developed market equities, excluding the U.S. and Canada”, has outperformed US indices in 2025.

The chart below shows EFA and SPY (total return) performance year to date.

Below is a relative chart, which shows the strong outperformance of EFA vs SPY since the beginning of 2025, despite underperforming substantially over longer time horizons.

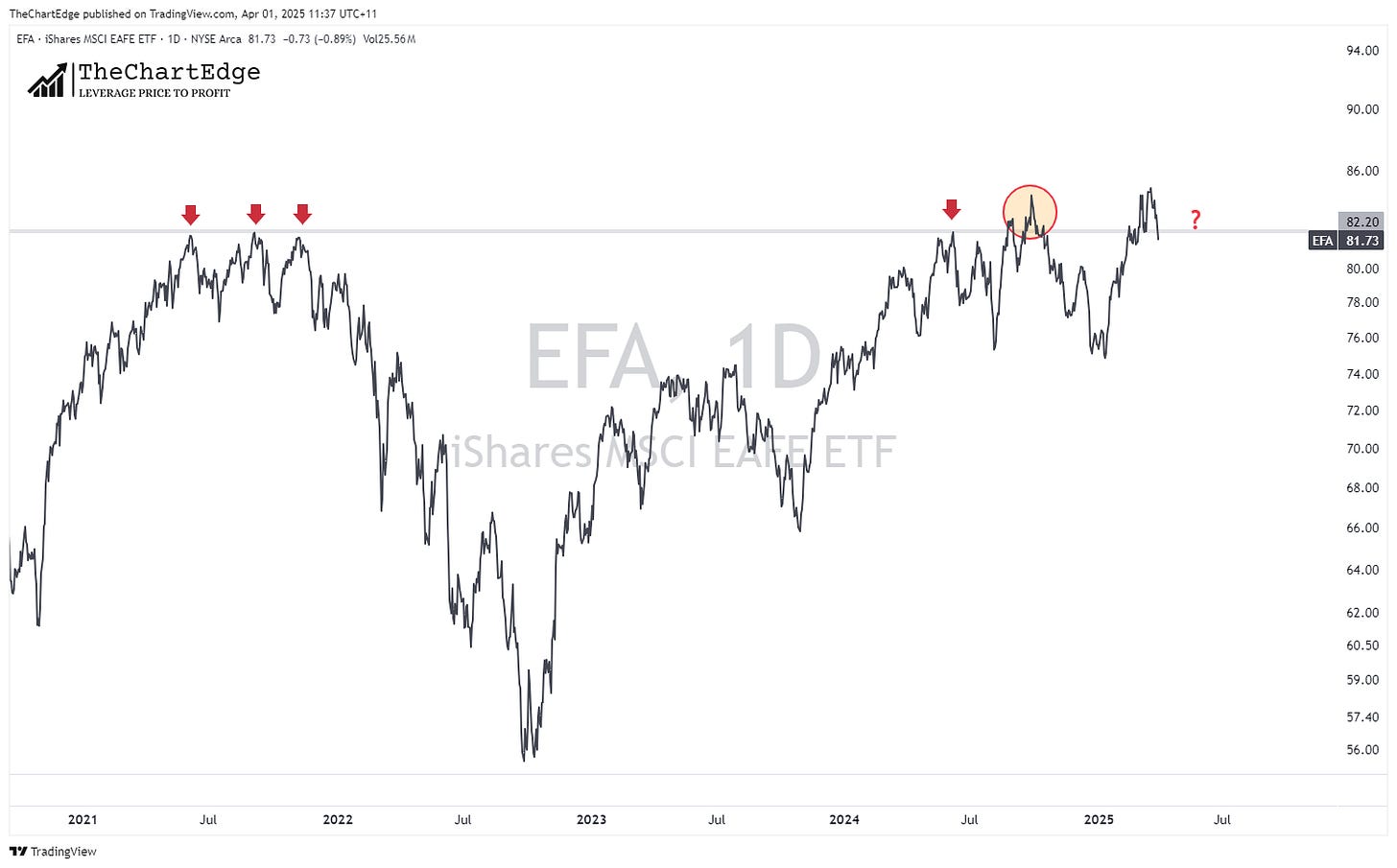

Here is a chart of EFA going back to 2021 and it looks like this may turn out to be a failed breakout for a second time.

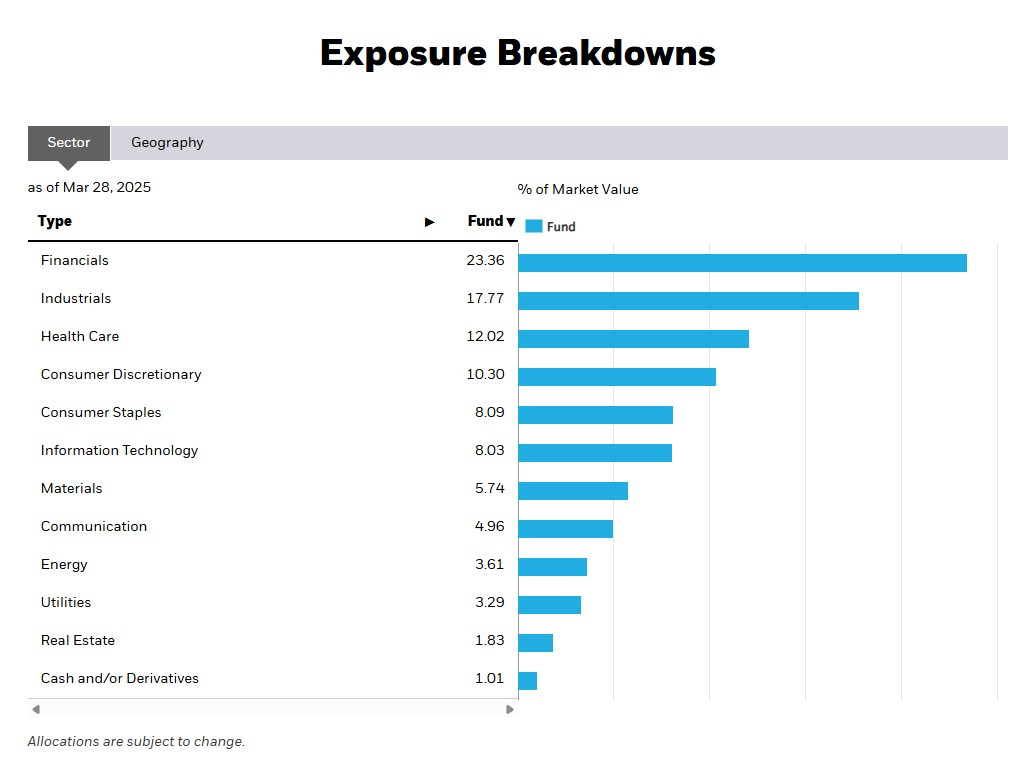

Below are the sector breakdowns within EFA. Notice there’s not a lot of technology.

Source: https://www.ishares.com/

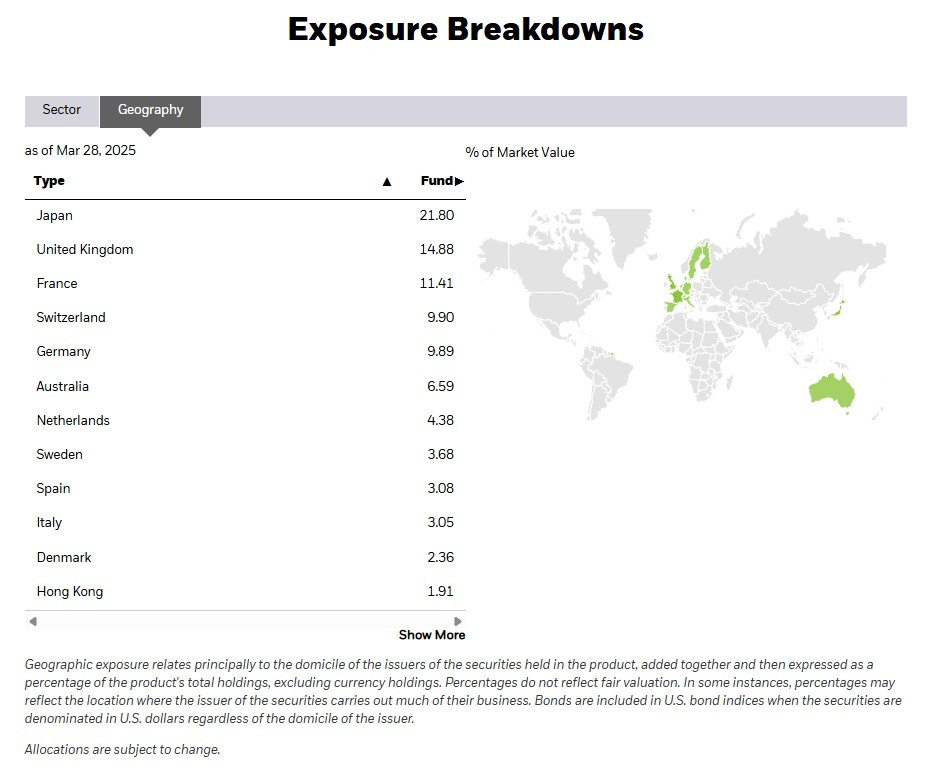

Below are the geographical breakdowns by country.

Source: https://www.ishares.com/

Looking at the main indices of the countries that dominate the stock exposure in the EFA, only Germany looks any good.

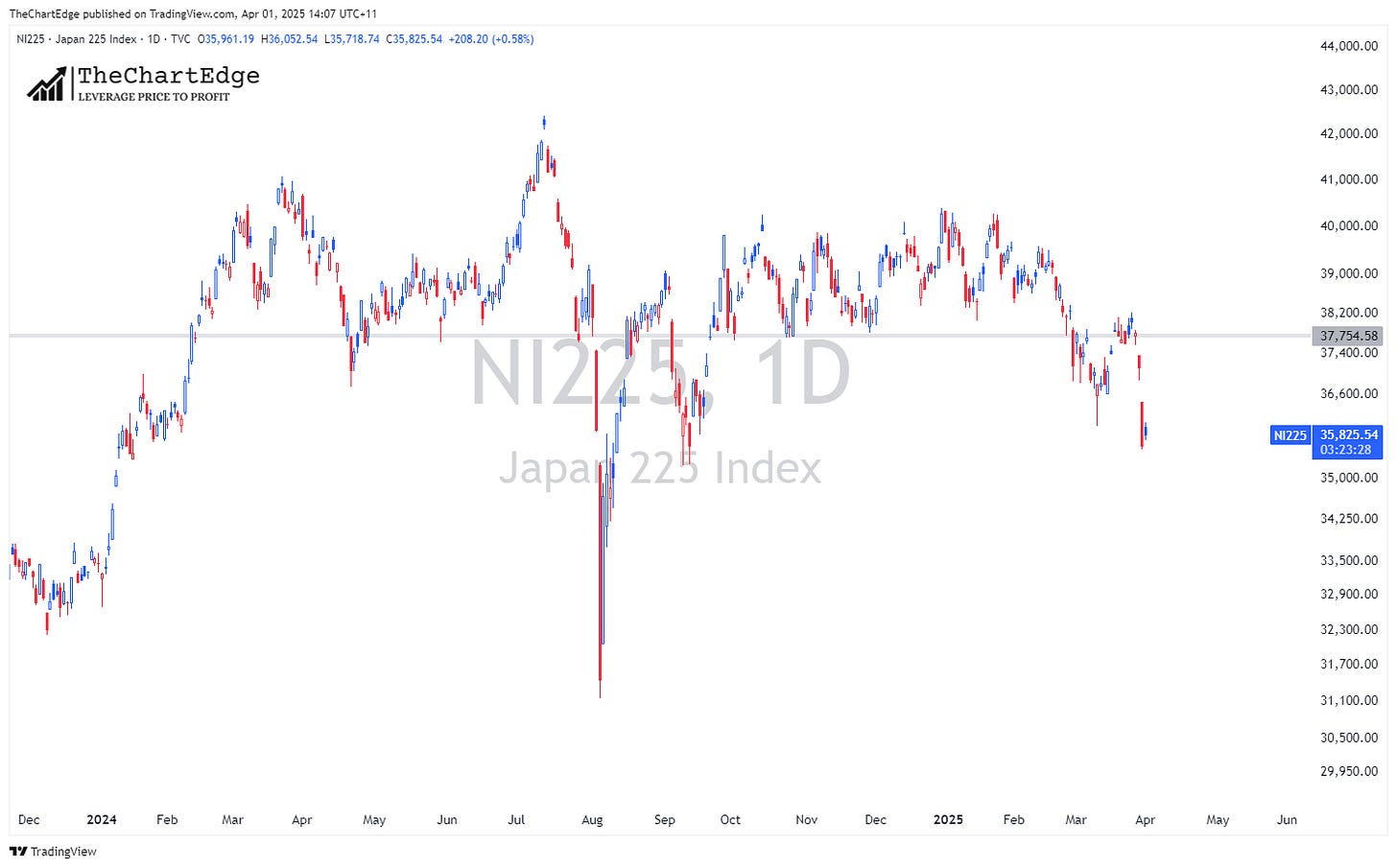

Japan looks bad.

Although not as bad as most of the others, the UK looks like it’s in for another sideway consolidation at best.

France looks bad.

Switzerland just had a failed breakout above the 2021/22 highs.

Germany was looking good, but after breaking down yesterday could fall further from here, unless it can reclaim the horizontal support/resistance and 50 day SMA.

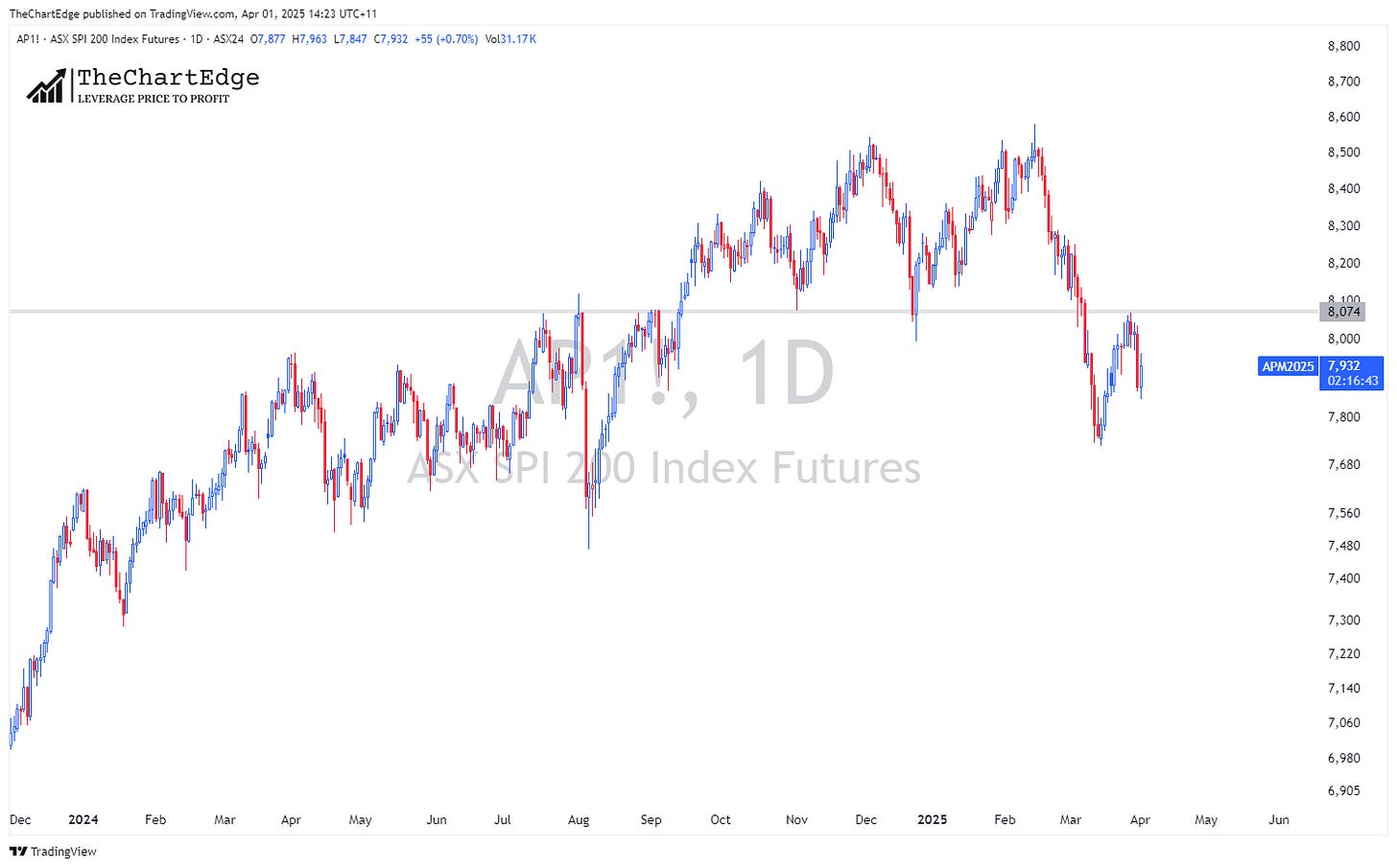

Australia also looks bad.

Hong Kong has been strong, so I decided to included it. However HK stocks are only a tiny weight in EFA. The HSI probably needs some time to consolidate for a while here. Which if it can do above the 50 day SMA would be very constructive. If not a fall back to around the 200 day SMA is not out of the question.

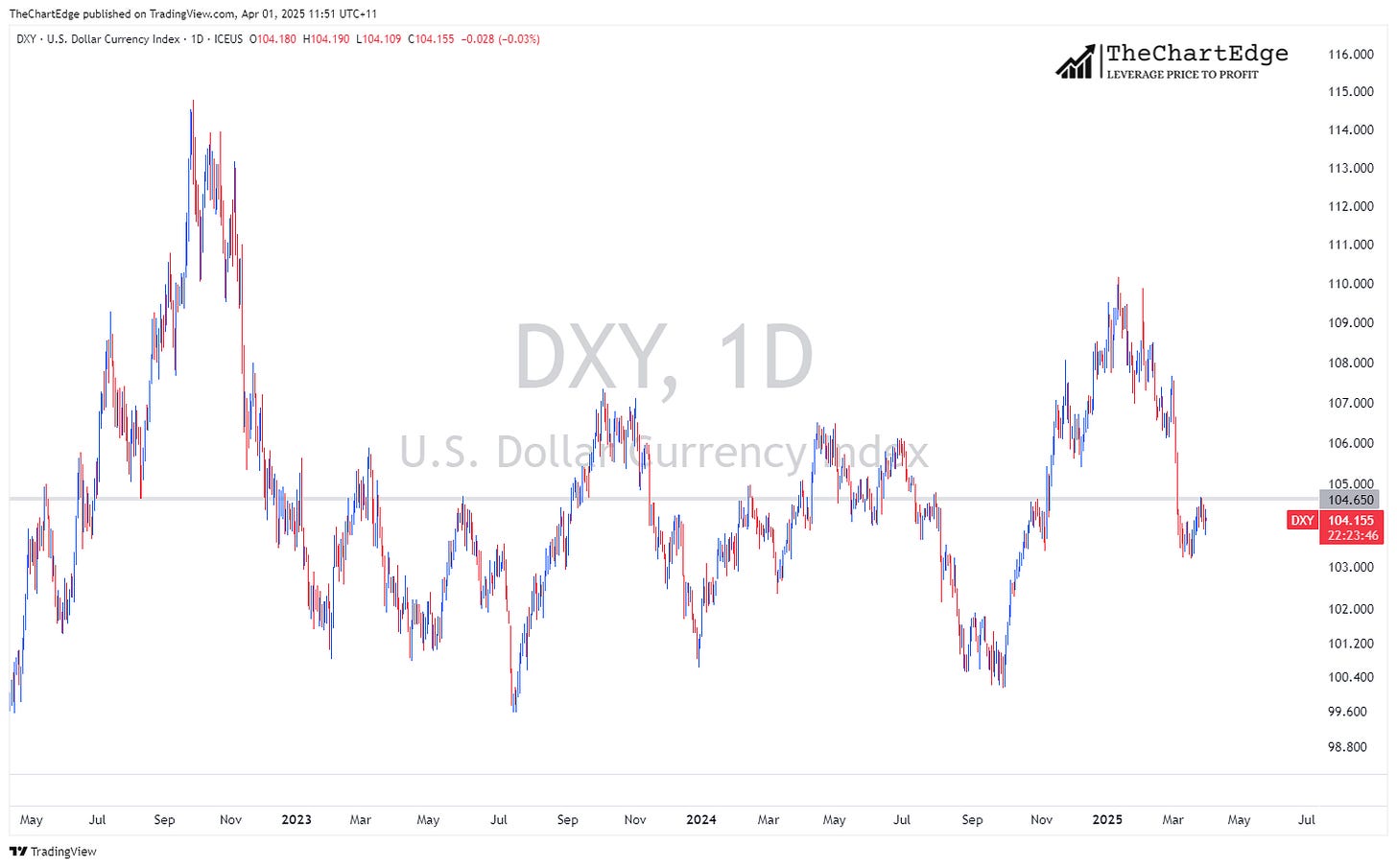

Part of the EFA outperformance in 2025 has been due to a weak US dollar. If markets continue to fall and the USD catches a bid in a “flight to safety”, this will hurt the performance of EFA, as it is priced in USD and unhedged. I’ll be watching the 104.65 level on the DXY.

Will international equities continue to outperform the US? I think it’s probably unlikely in the short to medium term. The major indices of the countries that make up the majority of the stock weightings in EFA, mostly don’t look very good priced in their local currency. If US indices have another leg down, I think international markets will follow, and the USD may catch a bid. On the other hand if US indices have a decent rally from here, it will likely be due to a rotation back into technology, which would also see EFA underperform. But lets see. Definitely one to watch.

Hope everyone has a great week!

Cheers!

Marcus Grant, CFTe

Disclaimer: The content provided in this newsletter is for informational and educational purposes only and should not be considered as financial, investment, or legal advice. The information shared is based on our research and analysis, but we are not a licensed financial advisor, nor can we guarantee its accuracy, completeness, or timeliness. Market conditions and financial instruments can change rapidly, and any opinions expressed may not be suitable for all investors. Any opinions expressed and or securities mentioned do not constitute a recommendation to buy, sell, or hold that or any other security. You should conduct your own due diligence and consult with a licensed financial advisor or other professional before making any investment decisions. Past performance is not indicative of future results, and all investments carry the risk of loss. The authors and publishers of this newsletter are not responsible for any financial decisions made based on the content provided herein. By reading and or subscribing to this newsletter, you acknowledge and agree that you are using the information at your own risk.