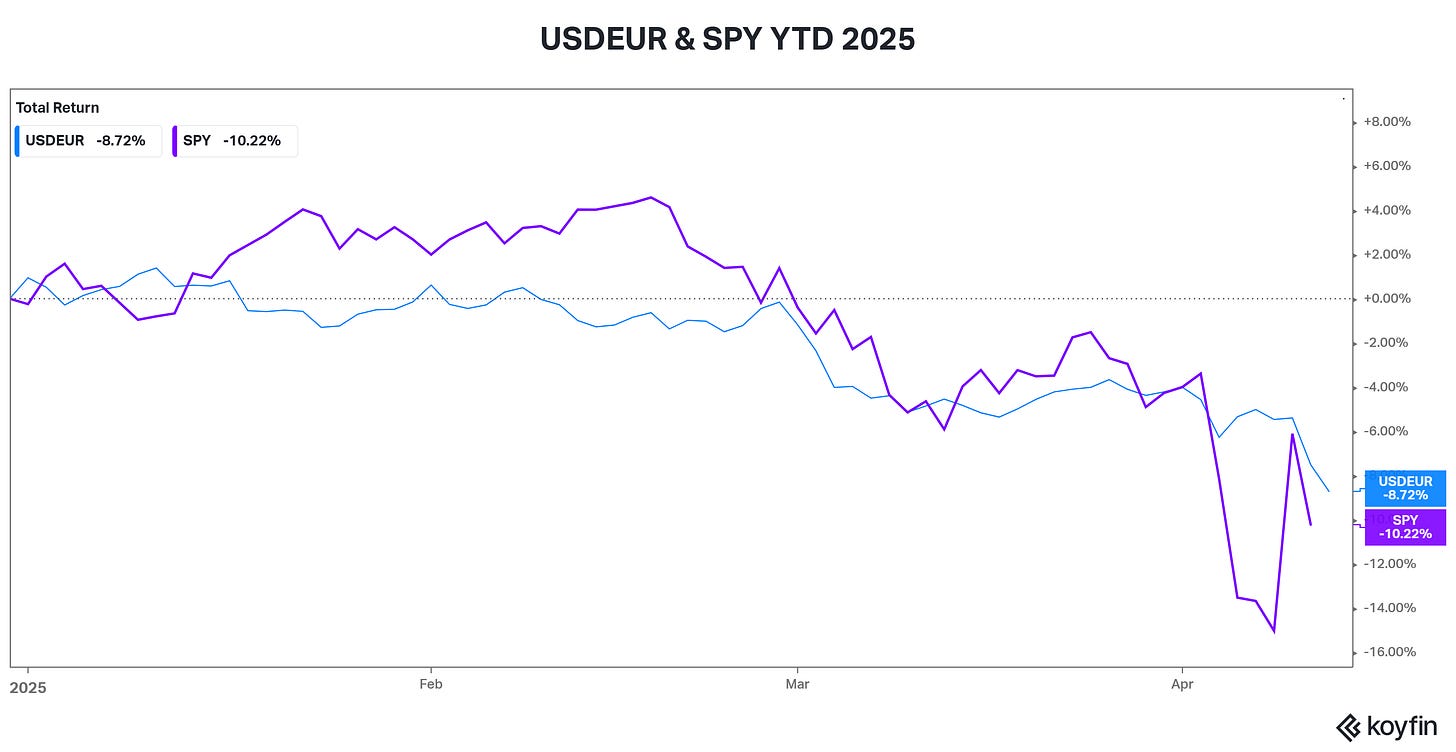

The US Dollar Has Been Very Weak in 2025

Could we see a mean reversion rally soon?

Currency markets have been very volatile recently. The USD is currently down around 9% year-to-date. It is a little bit surprising that there has been no bid for the USD in an environment where most stocks have been getting hammered since March. The “flight to safety” (i.e. a move towards USD or USD denominated “safe-heaven” assets) that is often seen in periods of uncertainty or market upheaval has not taken place this time, at least not yet. Some have suggested this time is different because the cause is the tariffs being imposed by the US on other countries. However if large tariffs are enacted and US trade with the rest of the world is reduced, it would reduce the supply of USD in the system, all else being equal.

Below is a chart of the USD/EUR & SPY year-to-date.

The US Dollar Index has also diverged significantly from the 10-year treasury yield. As you can see in the chart below, since 2023, they have followed each other quite closely, most of the time. However, in the last week or so, the 10-year yield has risen quite sharply, and the USD has done the complete opposite.

US Dollar Index chart:

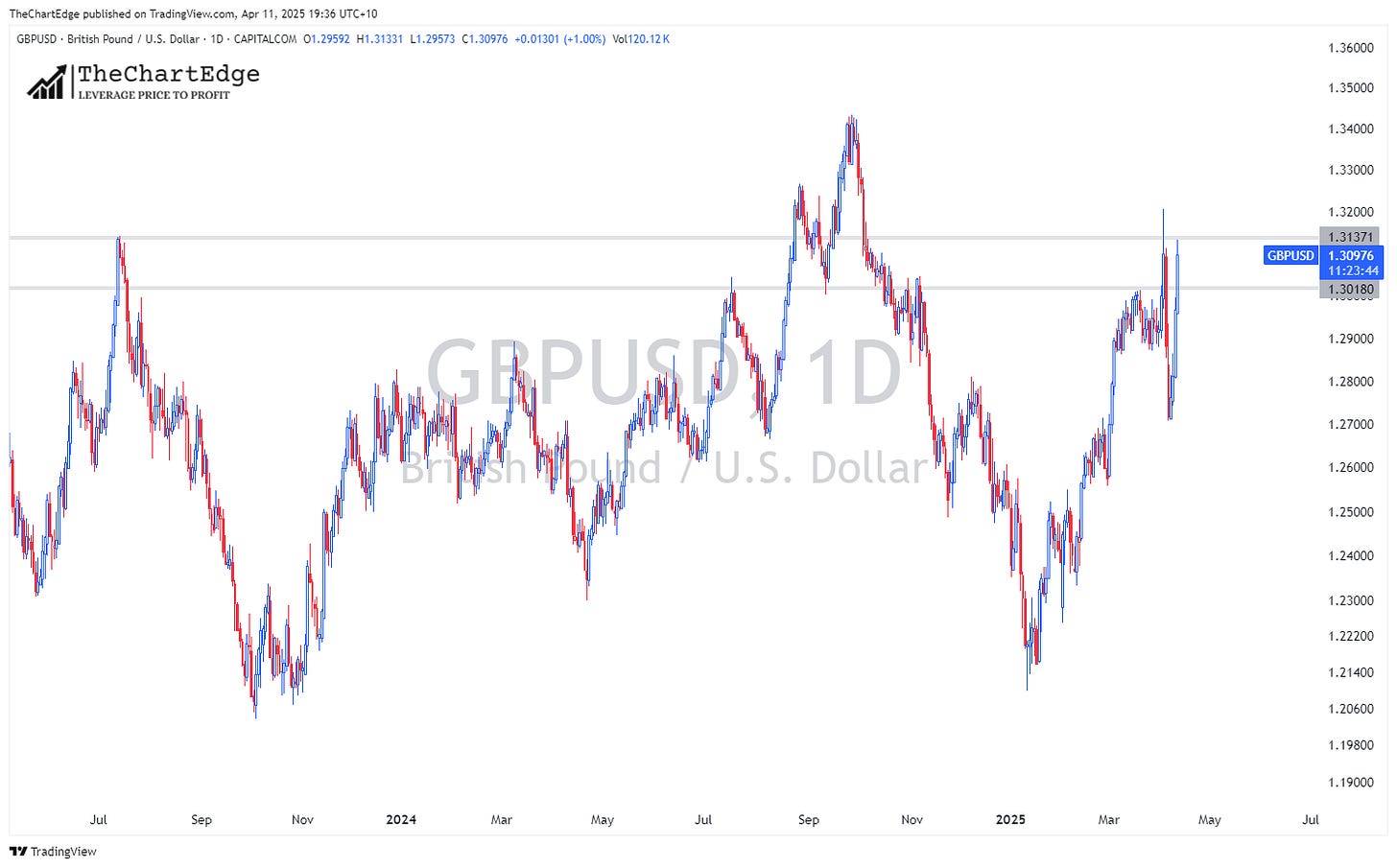

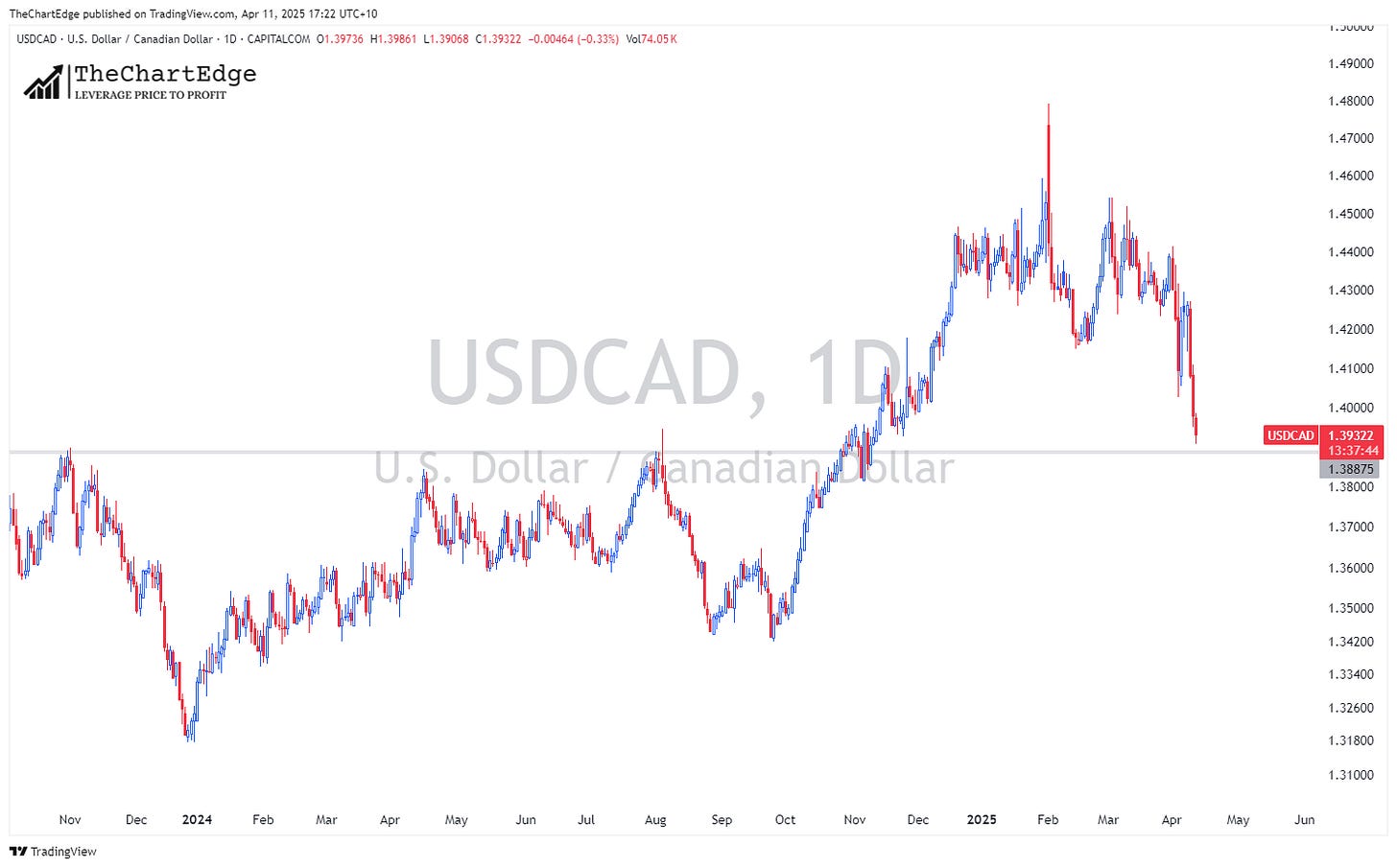

Here are some individual charts of the major currencies in the US Dollar Index.

EUR/USD:

USD/JPY:

GBP/USD

USD/CAD

USD/CHF

I wouldn’t be surprised to see a decent mean reversion rally in the USD in the coming days or weeks, but things are so unpredictable at the moment, anything could happen. However, if the USD keeps crashing like this, I don’t think that will be good.

What do you think?

Good Trading & Manage Risk Carefully!

Cheers,

Marcus Grant, CFTe

Disclaimer: The content provided in this newsletter is for informational and educational purposes only and should not be considered as financial, investment, or legal advice. The information shared is based on our research and analysis, but we are not a licensed financial advisor, nor can we guarantee its accuracy, completeness, or timeliness. Market conditions and financial instruments can change rapidly, and any opinions expressed may not be suitable for all investors. Any opinions expressed and or securities mentioned do not constitute a recommendation to buy, sell, or hold that or any other security. You should conduct your own due diligence and consult with a licensed financial advisor or other professional before making any investment decisions. Past performance is not indicative of future results, and all investments carry the risk of loss. The authors and publishers of this newsletter are not responsible for any financial decisions made based on the content provided herein. By reading and or subscribing to this newsletter, you acknowledge and agree that you are using the information at your own risk.