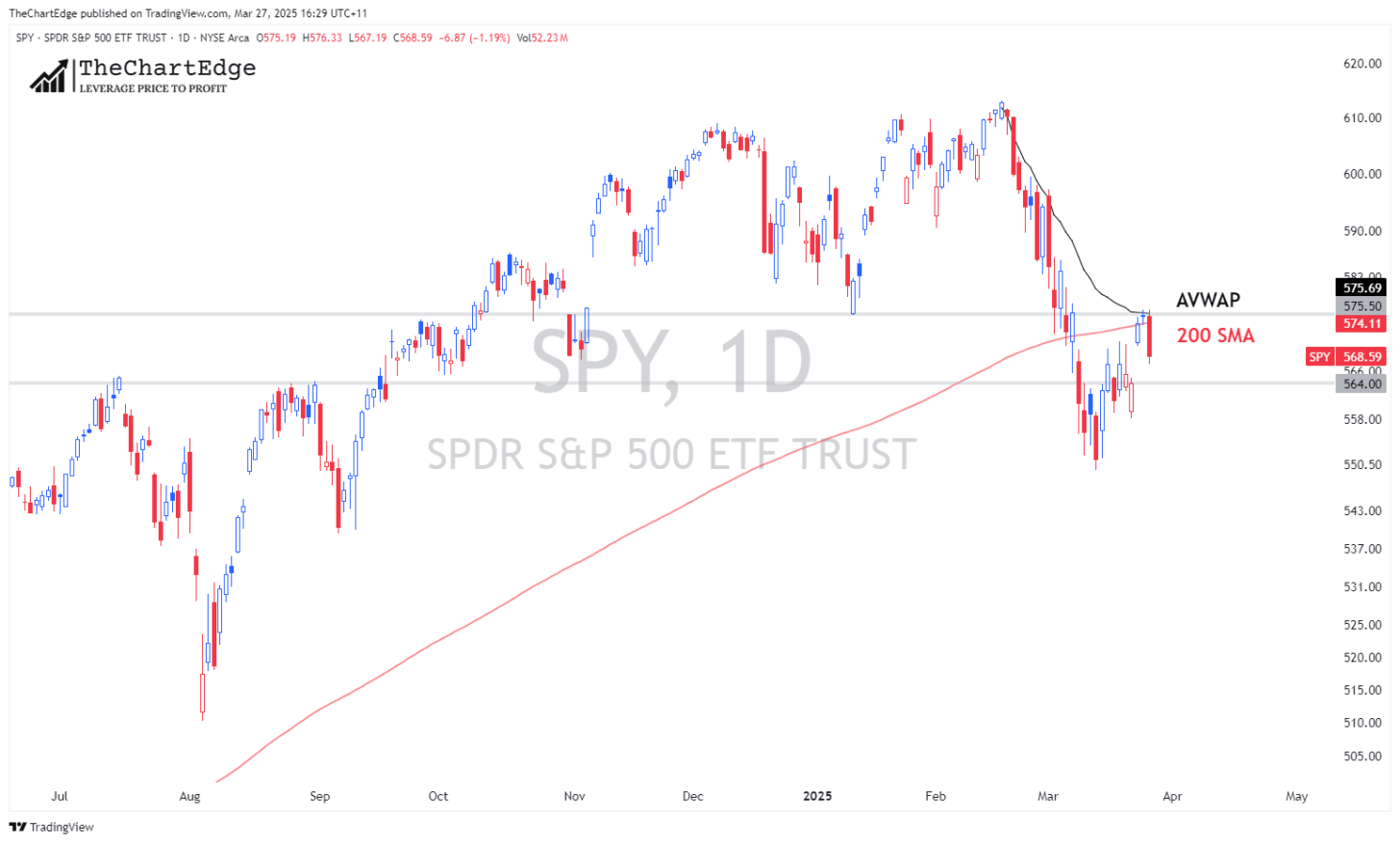

SPY Rejected at 575

Bulls want 564-565 to hold if the pullback continues

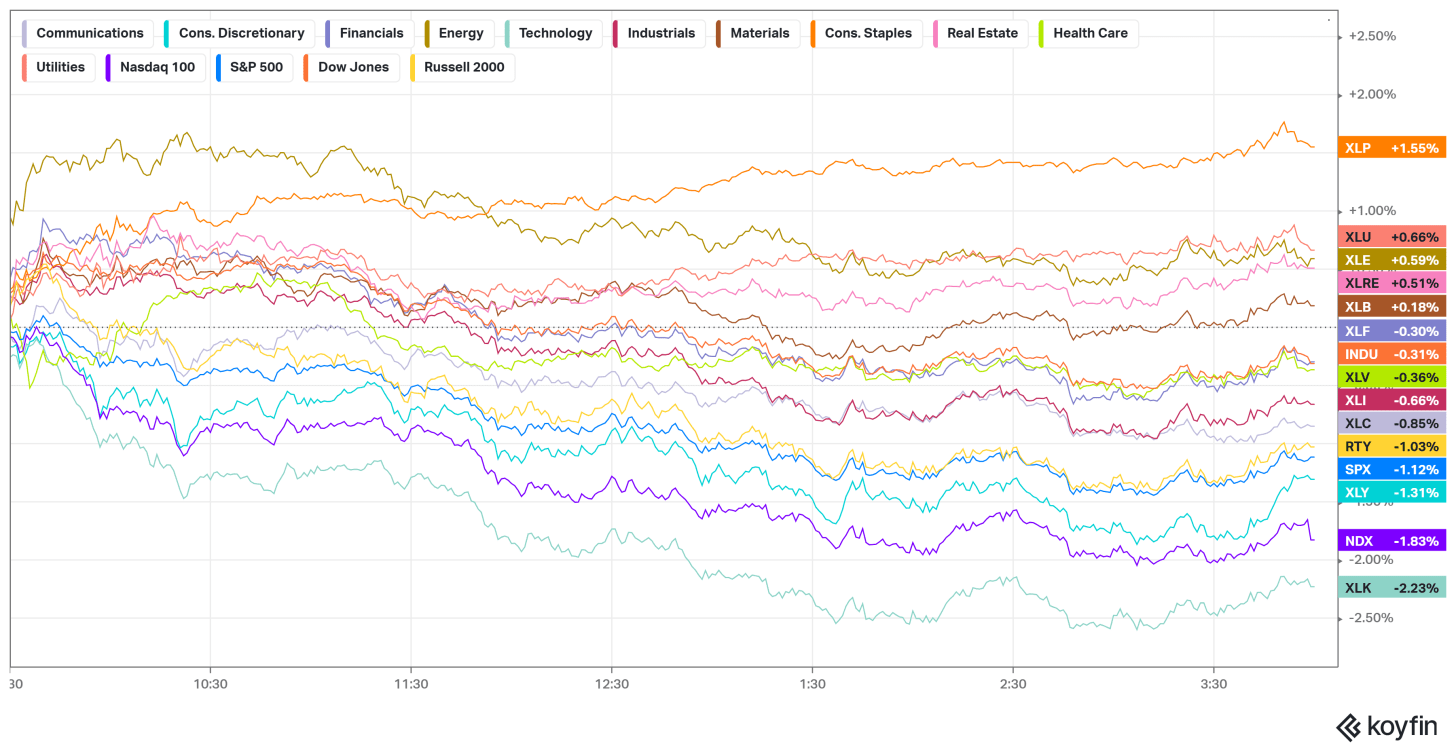

Wednesday March 26 was a pretty bad day for the US markets. Staples, Utilities, Energy, Real Estate and Materials were the only sectors in the green. Tech and Consumer Discretionary were hit the hardest, down 2.23% & 1.31% respectively. The Nasdaq 100 was the worst of the major indices, finishing down 1.83%. However many high beta growth names were down significantly more.

Looking at the SPY, it was rejected pretty hard after stalling at the AVWAP from the all time high. There was a confluence of potential resistance around this level, including the 200 day SMA and a previous horizontal support/resistance level, so it’s not surprising it didn’t just slice through this area on the first attempt.

However if SPY can hold 564-565 on any further pullback, the short term uptrend on the 65 minute chart is still intact and it may build for another attempt to break through 575. If we lose 564-565 however, which would be below the AVWAP from the recent lows and the gap fill from Monday’s gap up, we may see a retest of the recent lows and potentially further downside.

Following up on the trades I mentioned in my last post (link). I was filled on SPOT, which closed down slightly from my entry. NFLX & PLTR haven’t been filled, but I will leave both resting orders for now.

Happy Trading!

Marcus Grant, CFTe

Disclaimer: The content provided in this newsletter is for informational and educational purposes only and should not be considered as financial, investment, or legal advice. The information shared is based on our research and analysis, but we are not a licensed financial advisor, nor can we guarantee its accuracy, completeness, or timeliness. Market conditions and financial instruments can change rapidly, and any opinions expressed may not be suitable for all investors. Any opinions expressed and or securities mentioned do not constitute a recommendation to buy, sell, or hold that or any other security. You should conduct your own due diligence and consult with a licensed financial advisor or other professional before making any investment decisions. Past performance is not indicative of future results, and all investments carry the risk of loss. The authors and publishers of this newsletter are not responsible for any financial decisions made based on the content provided herein. By reading and or subscribing to this newsletter, you acknowledge and agree that you are using the information at your own risk.