SPY & QQQ Undercut & Rally

Chance for further upside, but there are still signs of weakness

Yesterday, on March 31st, the SPY and QQQ gapped down on the open, undercutting the low from March 13th, taking out anyone who had placed their stop loss just under this level, then proceeded to rally throughout the day. This kind of price action can shake out the weaker hands and set the stage for a rally, especially if the market shows further strength over the next few sessions.

I was stopped out of the 3 swing trades I mentioned in this post (link) and will sit on my hands observing for now. I think we must be open minded to further downside.

Although the undercut and rally setup can often provide a good entry, I am not yet convinced that the bottom is in. Personally, I want to see more evidence before putting on any new swing trades.

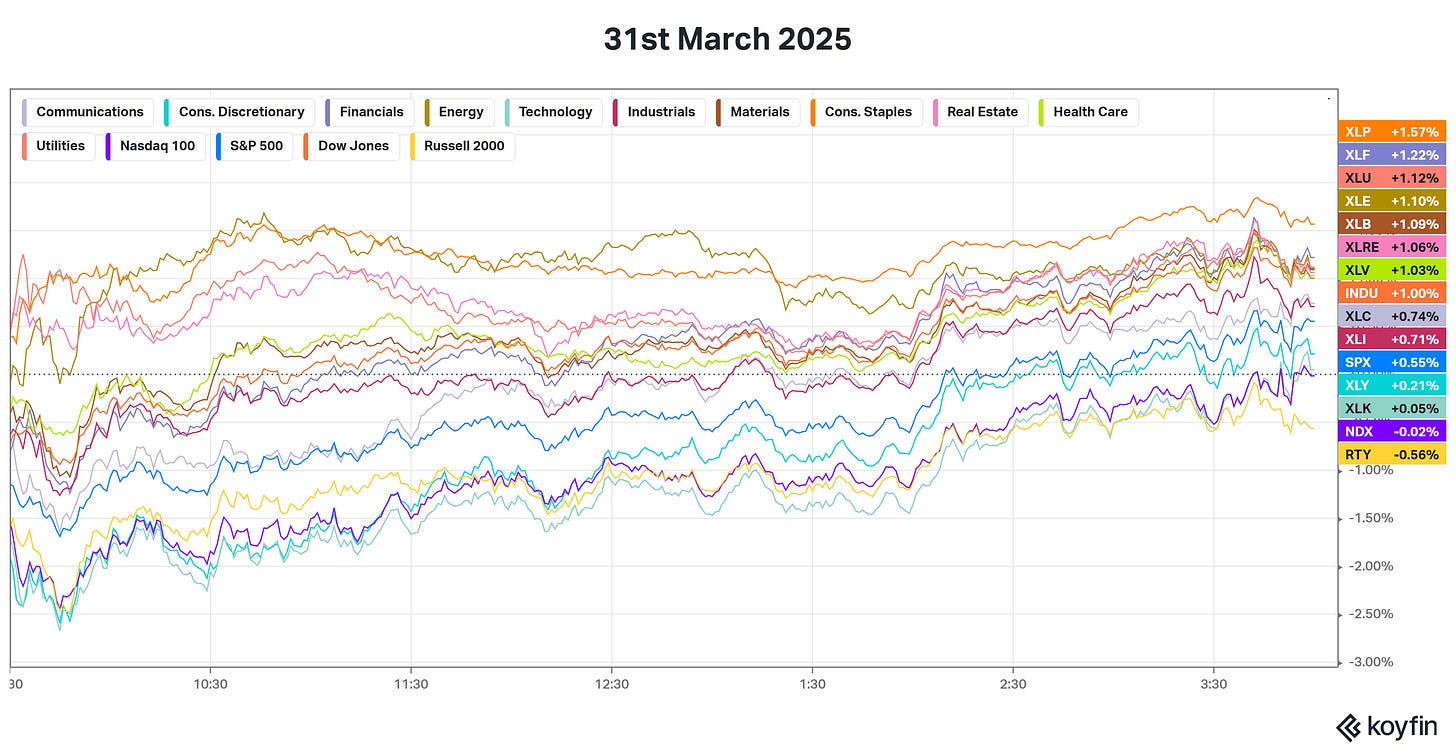

Here are some of the reasons I am not yet convinced. Yesterday’s rally was led by the more defensive sectors, XLP & XLU, while XLY, XLK & NDX lagged.

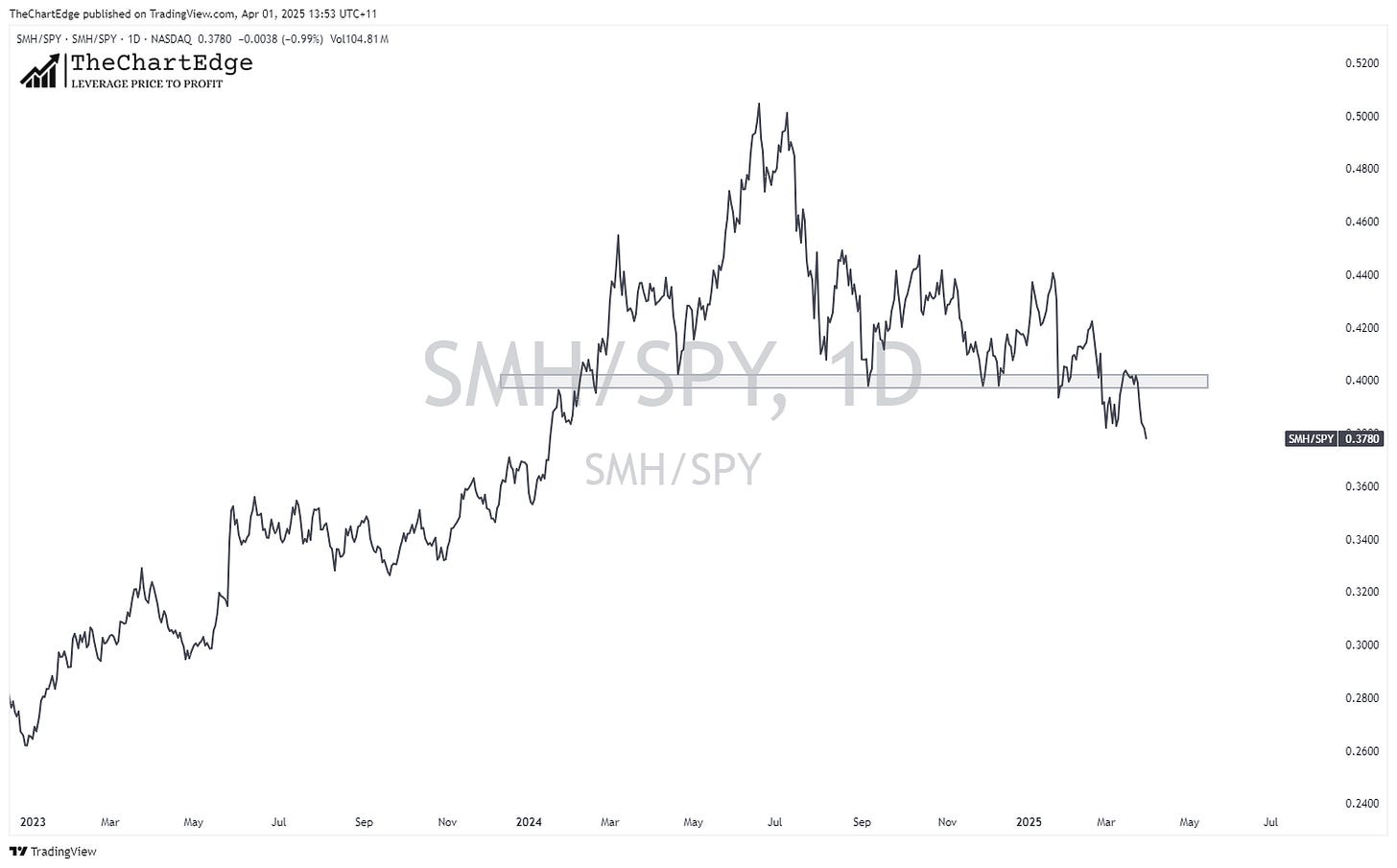

Semis (SMH) relative to SPY made a new lower low, under for what is now a completed topping pattern.

As did Tech (XLK) relative to SPY.

If SPY is to have a sustained rally, I think these 2 tops need to reverse and become failed tops.

Growth relative to value also made a new lower low. IWF is the iShares Russell 1000 Growth ETF, and IWD is the iShares Russell 1000 Value ETF. The top pane of the chart shows the IWF/IWD ratio, and the bottom pane shows the SPX.

Equal-weight consumer discretionary relative to equal-weight consumer staples also made a new lower low. RSPD is the Invesco S&P 500® Equal Weight Consumer Discretionary ETF, and RSPS is the Invesco S&P 500® Equal Weight Consumer Staples ETF. Again, the top pane of the chart shows the ratio, and the bottom pane shows the SPX.

These 2 ratios are a good measure of risk-on vs. risk-off and tend to track the SPX quite closely. However, not all divergences mean the SPX will follow, and there are other ratios of risk-on vs. risk-off that did not make lower lows yesterday. However, I will remain cautious and open-minded to the possibility of further downside until I get more evidence that things are starting to turn.

Hope everyone has a great week!

Cheers!

Marcus Grant, CFTe

Disclaimer: The content provided in this newsletter is for informational and educational purposes only and should not be considered as financial, investment, or legal advice. The information shared is based on our research and analysis, but we are not a licensed financial advisor, nor can we guarantee its accuracy, completeness, or timeliness. Market conditions and financial instruments can change rapidly, and any opinions expressed may not be suitable for all investors. Any opinions expressed and or securities mentioned do not constitute a recommendation to buy, sell, or hold that or any other security. You should conduct your own due diligence and consult with a licensed financial advisor or other professional before making any investment decisions. Past performance is not indicative of future results, and all investments carry the risk of loss. The authors and publishers of this newsletter are not responsible for any financial decisions made based on the content provided herein. By reading and or subscribing to this newsletter, you acknowledge and agree that you are using the information at your own risk.