S&P 500 KNOCKING ON THE DOOR

Can the SPX breakout to new all time highs without the Mega-Caps?

So, this is my first Substack post. Hope you all like it and find it of some value. Please feel free to get in touch with any feedback or just to say G’day. I’ll try to post weekly from now on with some analysis, trade ideas and or trading wisdom I have learned from those who have come before us. I’ll do a post in the future with my favorite trading books and resources.

Just a little about me before I get into it……

My name is Marcus and I’m from Melbourne, Australia. I did a finance degree at Melbourne Uni over 2 decades ago (time flies!) and am currently undertaking the CMT Program. For those that don’t know, its a global designation for practitioners of technical analysis.

I started trading seriously in 2008, at the onset of The Great Recession or GFC (as we call it in Australia), which was quite the induction. I got smashed around a bit, but learnt many good lessons the hard way, which have stood me in good stead. I mostly trade CFDs (contracts for difference) which are very popular in Australia, the UK and Europe, but are banned in the US because they are an over-the-counter (OTC) trading product. Anyway, you can basically trade anything with CFDs, currencies, indexes, stocks, commodities, crypto, futures and even some options now.

Anyway, enough about me……

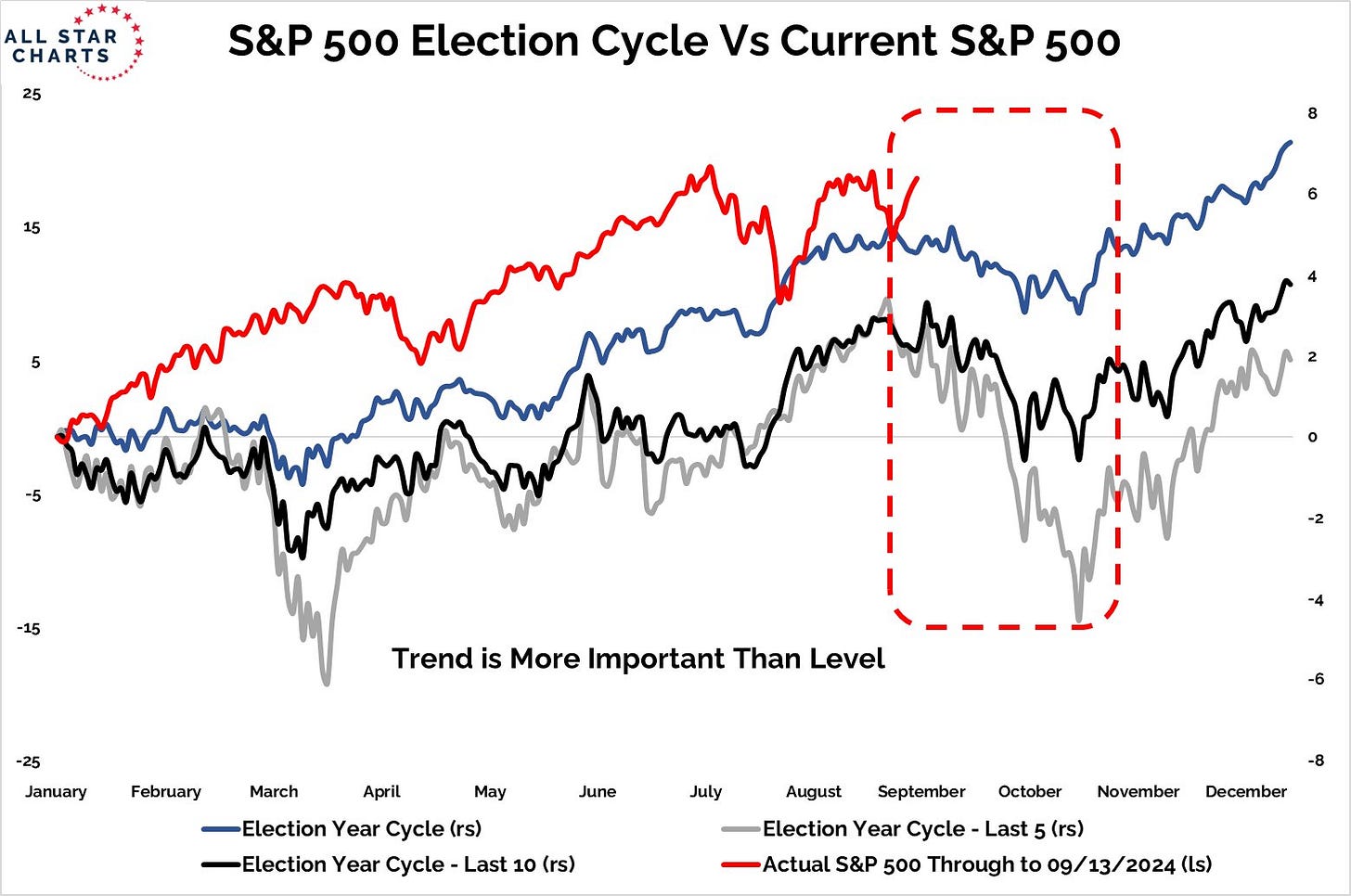

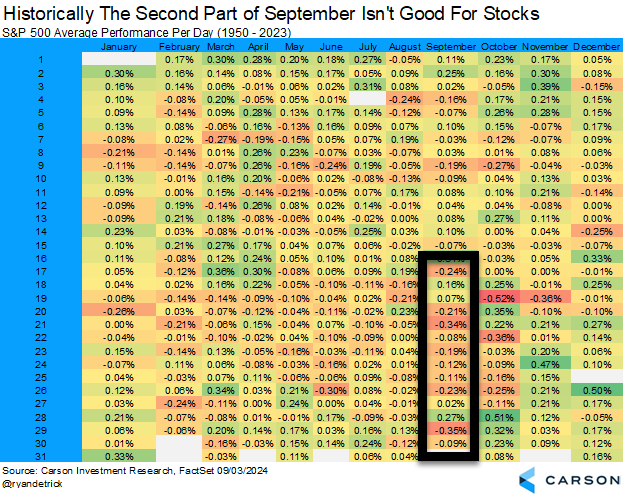

Currently there are some potentially bearish headwinds from seasonality, and uncertainty with the upcoming US Election, which we should be mindful of.

H/T Grant Hawkridge and Ryan Detrick

Source: Grant Hawkridge

Source: Ryan Detrick

The bears are pointing to the negative forward returns after the first rate cut of the cycle in 2000 & 2007, and some are saying the un-inversion of the yield curve will lead to a recession and a new bear market . However the reality is the S&P 500 is right up against resistance, knocking on the door of all time highs. And all this without the biggest, most important stocks (in terms of market cap weight in the index) leading.

Here is a zoomed out SPY chart making its third attempt to break through 562.

And a closer zoomed in look below:

I have the year-to-date AVWAP on the chart, which is a level that should hold on any future near-term pullbacks if the market remains healthy. You can see it acted as support already twice this year. H/T Brian Shannon, his new book, Maximum Trading Gains with Anchored VWAP, is a must read in my opinion.

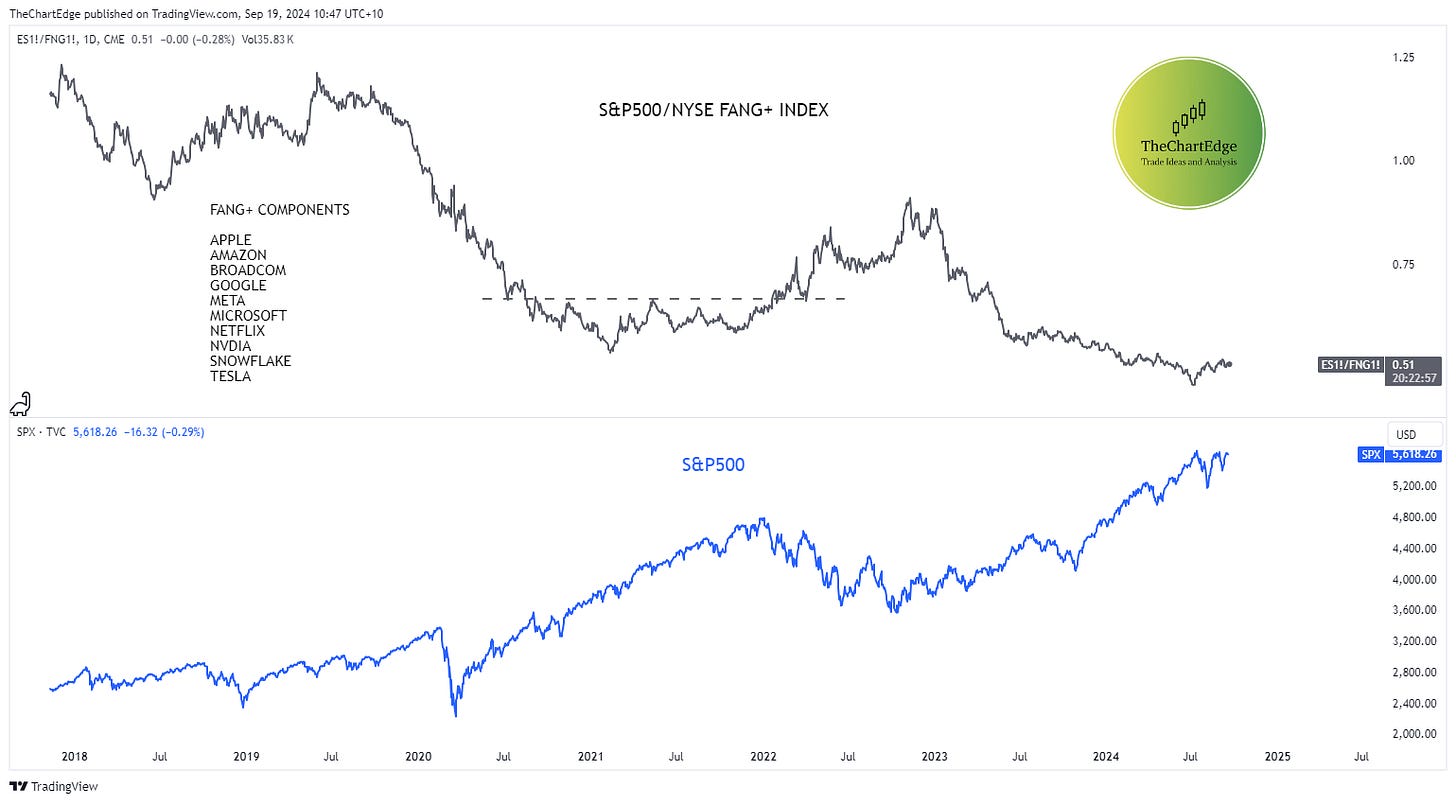

In the chart below, which shows the S&P 500 relative to FANG+ index, as the line goes down, mega-caps are outperforming the S&P 500, and when the line goes up, the S&P 500 is outperforming mega-caps. You can see it has turned up recently, as it did in early 2021, which means mega-caps are underperforming.

But until this relative chart reverses its current downtrend and becomes an uptrend, I think the S&P 500 is likely to continue to go higher. You can see in the chart below the S&P 500 continued to go higher throughout 2021, despite the S&P500/FANG+ ratio going sideways. It wasn’t until the S&P500/FANG+ ratio chart broke out to the upside at the start of 2022, that the S&P 500 began its severe 2022 decline. The ratio then peaked just after the S&P 500 bottomed in Oct 2022.

As long as mega-caps don’t fall apart, I think the S&P500 can and will go higher from here. Maybe not right away…it’s certainly possible more consolidation and time is required. But if the mega-caps start leading again (i.e. the ratio chart continues its top left to bottom right trajectory) the S&P 500 will breakout sooner rather than later.

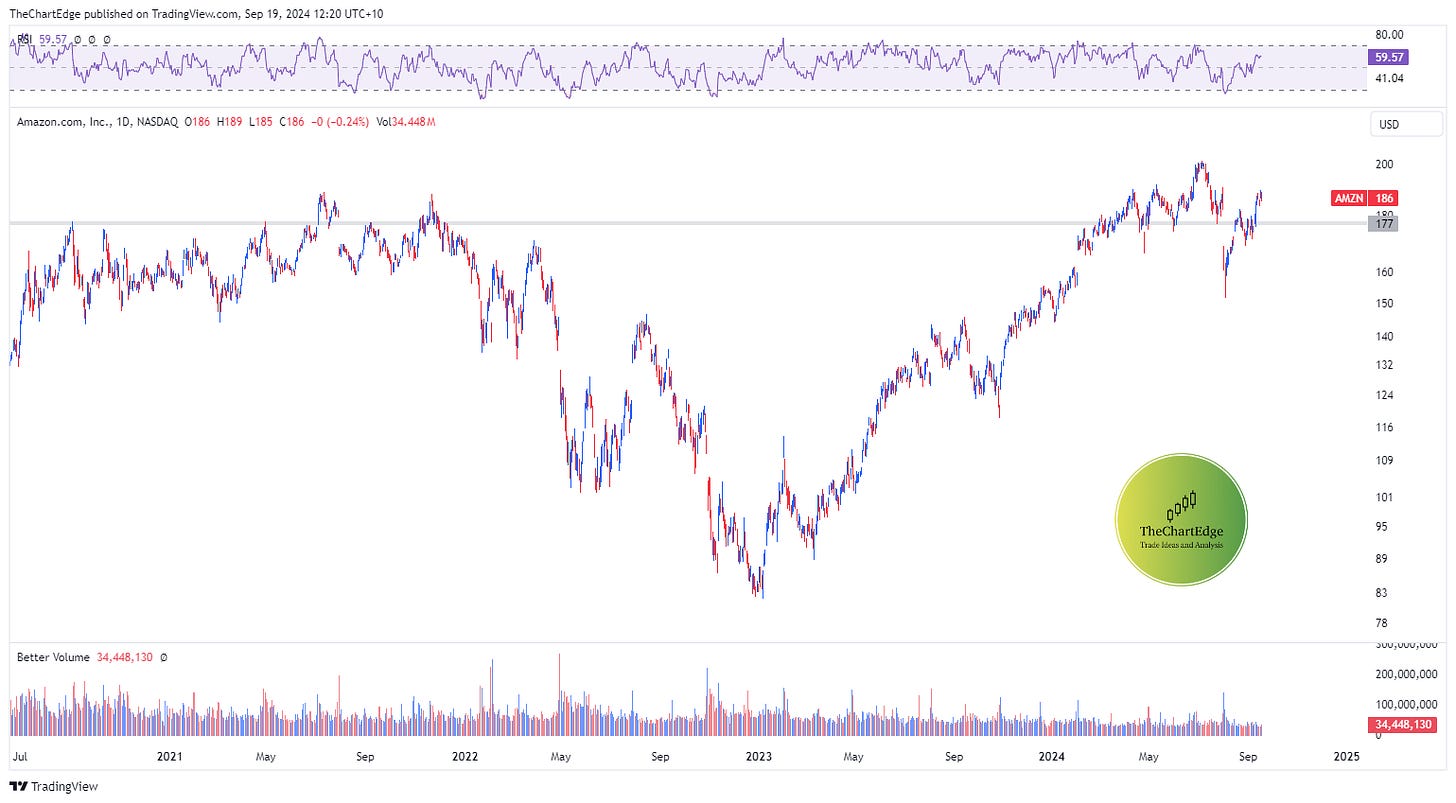

So, on the flip side, if this is to become a stage 3 top in the S&P 500, and we are going into a new correction or bear market, we will start to see the mega-caps breakdown one by one. Below is the FANG+ index chart and the individual stock charts that are in the FANG+ index, with the prices I think are important and need to hold.

FANG+ above 10,400.

Apple above 198.

Amazon above 177.

Broadcom above 141.

Google above 150.

Meta above 455.

Microsoft above 400.

Netflix above 585.

Nvidia above 98.

Snowflake looks like shit and should probably be kicked out of the FANG+ index, but maybe it can hold its lows here…..

Last but not least, Tesla is a choppy sideways mess, but it did go up nearly 3000% between Oct 2019 and Oct 2021, so a few years of sideways consolidation since then is probably well warranted…

So, in conclusion, I think patience could be required here. But there is definitely no reason to get bearish until some of the levels outlined above start getting taken out. Also the S&P 500 futures are currently indicating an open in the cash market around 5715. I am not going to chase here, but if we close today above 5700 and follow through on Friday (20/9/2024) I will be adding to my long positions next week. I will do a new post early next week with details if that happens. For disclosure, I am currently long weekly SPX 5700 call options, which expire end of day Friday, but it’s not a big position. I also have some long exposure in individual S&P 500 stocks, which I will elaborate on in a post next week. I am also long gold, via options on the Dec futures contract with a $2550 strike price, and WTI crude oil, also via options, on the Nov futures contract, with a $71 strike price. I’ll try to do posts on my analysis of those commodities and positions, as well as some crypto stuff in the next week or 2.

Thanks to those who read to the end! Let me know what you think, I’d love some feedback, or leave a comment, and please subscribe and or share the post with friends who may also enjoy it!

Cheers,

Marcus

Disclaimer: The content provided in this newsletter is for informational and educational purposes only and should not be considered as financial, investment, or legal advice. The information shared is based on my research and analysis, but I am not a licensed financial advisor, nor can I guarantee its accuracy, completeness, or timeliness. Market conditions and financial instruments can change rapidly, and any opinions expressed may not be suitable for all investors. Any opinions expressed and or securities mentioned do not constitute a recommendation to buy, sell, or hold that or any other security. You should conduct your own due diligence and consult with a licensed financial advisor or other professional before making any investment decisions. Past performance is not indicative of future results, and all investments carry the risk of loss. The authors and publishers of this newsletter are not responsible for any financial decisions made based on the content provided herein. By reading or subscribing to this newsletter, you acknowledge and agree that you are using the information at your own risk.